by Jerry Friedman

There is a story that when the late union leader Walter Reuther was given a tour of a GM plant, a manager introduced him to a set of the company’s new robots. The manager challenged Reuther to say how he would organize the robots into the UAW. The union leader supposedly responded by asking: how will General Motors sell cars to the robots? While American unions have failed to organize the workers in the new economy’s factories, its capitalists seem to have figured out a good answer to Reuther’s question.

We shouldn’t be surprised that conservative politicians and orthodox economists are calling for the Federal Reserve to end its program of monetary ease and for the Federal government to end its program of extended unemployment insurance. Believing in Say’s Law and the virtues of unregulated markets, they have never been comfortable with state action to help the unemployed; instead, they have long argued that the only proper role for government is to protect price stability and the integrity of banking system.

What should surprise us is that so few in the business community are pushing back against these ideologues in support of policies to bolster economic growth and employment. Robert Reich asks whether capitalists and managers have forgotten the basic Fordist compromise, in which businesses rely on affluent workers to consume their products?[1] If a rising tide lifts all boats, don’t capitalists benefit when unemployment falls and workers have more to spend? And shouldn’t they support policies that bring the tide in?

They don’t because American capitalists have learned to profit from recession. They have so well insulated their economic fortunes from the rest of us, that they no longer depend on rising wages and growing effective demand to maintain profitability. The “recovery” from the Great Recession of 2008 has been different from past recoveries, because it has been led by profits, which have grown even though economic growth has been relatively slow, and employment and wages have stagnated. Four years into the “recovery,” the GDP has grown at an anemic 2.4% per annum, the slowest growth rate of any post-war recovery and less than half that of the recovery in the 1960s. Since the recession bottomed out in 2009, job creation has been only a third the rate of past recoveries. Compared with past recoveries, this one is short 8 million jobs and the employment ratio, the share of the adult population with jobs, has fallen back to the level of the early 1970s, down 5 percentage points from 2008.

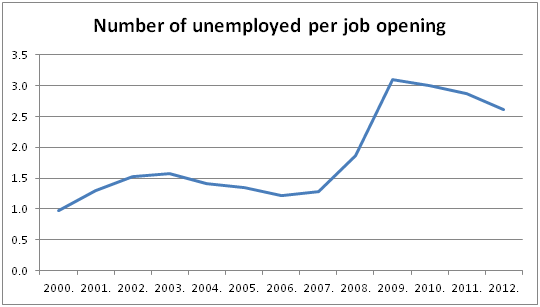

Those who call for the Federal Reserve to reverse course and urge Congress to cut programs to help the jobless cite the declining unemployment rate, which is down a third from its peak in 2009. While declining unemployment is a good thing, much of the decline in the unemployment rate is because 10 million people have left the labor force. The number of discouraged workers remains above its late 2009 level, while the number of unemployed workers per job opening has fallen only slightly from its 2009 peak (see Figure 1). With the weight of unemployed and underemployed workers on the job market, wages have remained stagnant in this recovery despite rising productivity, continuing a decades-long trend.

.

Despite slow economic growth, little job creation, and stagnant wages, some parts of the economy have boomed: the stock market and corporate profits. After dramatic drops early in the recession, the Dow Jones Industrial Average has risen to new highs, growing in real terms significantly faster than in past recoveries. While there may be some speculative element to the run-up in the Dow, it is well-supported by corporate profits, which have recovered fully from a sharp fall when the recession began to renew a 30 year climb (see Figure 2).

At least for now, American capitalists have solved the problem that bedeviled their Fordist forebears. They have found ways to profit even when their workers cannot buy their stuff. Since 2009, inflation-adjusted spending by the top 5% has risen 17 percent, compared with an anemic 1 percent among the rest.[2] While Sears and J.C. Penney drift towards bankruptcy, Nordstrom and other luxury brands flourish. Rather than depending on sales to working-class and middle-class consumers American corporations are doing very well selling to rich consumers, here and abroad. Rather than promising workers high wages to ensure productivity, they maintain labor discipline through fear.

It seems that capitalists and managers have found answer to Reuther’s question. Business can’t sell stuff to robots, but they don’t need to sell stuff to workers either.

[1] “Why The Three Biggest Economic Lessons Were Forgotten,” accessed February 13, 2014, http://robertreich.org/post/76339971895.

[2] Nelson D. Schwartz, “The Middle Class Is Steadily Eroding. Just Ask the Business World.,” The New York Times, February 2, 2014, http://www.nytimes.com/2014/02/03/business/the-middle-class-is-steadily-eroding-just-ask-the-business-world.html; Barry Z. Cynamon and Steven M. Fazzari, Inequality, the Great Recession, and Slow Recovery, SSRN Scholarly Paper (Rochester, NY: Social Science Research Network, January 23, 2014), http://papers.ssrn.com/abstract=2205524.